Ah, the joys of shipping. Whether it’s a care package for your long-distance bestie or a batch of artisanal hot sauce for your grandma in Florida, getting your goods from point A to point B can be a bit of a hassle. And don’t even get us started on the nightmares of damaged or lost packages. That’s where UPS shipping insurance comes in – your trusty sidekick in the world of shipping woes.

But if you’re scratching your head about what it is and how it works, fear not! The ultimate guide to UPS shipping insurance is here to save the day. We’ll break down this shipping savior’s nitty-gritty details so you can confidently ship.

| Table of Content |

What is UPS shipping insurance?

Have you ever shipped a valuable item and felt the anxiety of wondering if it would arrive safely? Well, fear not! UPS offers a solution in the form of shipping insurance, which provides coverage for the value of your shipment against loss, damage, or theft during transit.

The process is simple: when you opt for shipping insurance, UPS assumes liability for the declared value of your package up to the specified coverage amount. But don’t worry, you won’t have to break the bank to ensure your package’s safety, as UPS offers different levels of insurance coverage depending on the value of your item and the type of service you choose.

For example, most shipments automatically receive $100 of basic coverage, but if you’re shipping something worth more, you can purchase additional declared value coverage. It’s a small price to pay for peace of mind. There are a few restrictions, of course. Hazardous materials and perishable goods are not eligible for coverage, but UPS insurance is available for most items. However, some items like electronics, jewelry, and artwork require additional documentation or packaging to ensure safe transport.

How Much Does UPS Shipping Insurance Cost?

When shipping your valuable goods, it’s always a good idea to have a backup plan in case of unexpected mishaps. That’s where UPS shipping insurance comes in handy! This service provides coverage against loss, damage, or theft during transit, giving you peace of mind and protection for your precious cargo.

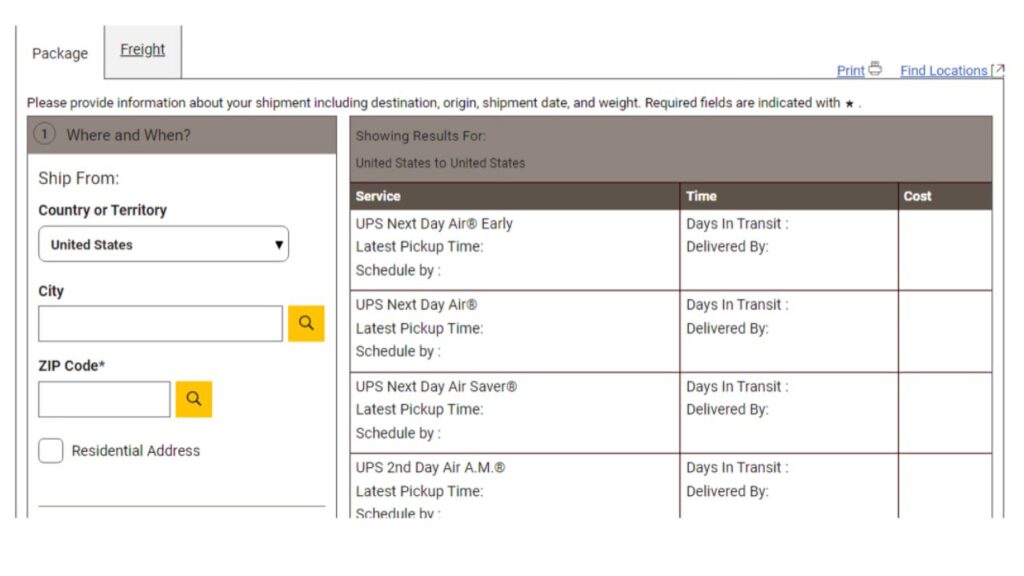

But how much does this coverage cost? Well, it depends on a few factors, such as the declared value of your shipment, its destination, and the type of service used. The good news is that the UPS shipping insurance rates are generally quite reasonable, ranging from $0.50 to $2.70 per $100 in value. Plus, there’s a minimum charge of just $2.50, so even smaller shipments can be covered without breaking the bank.

Of course, there is a declared value fee of 1% of the declared value with a $3.50 minimum, but that’s a small price to pay for the added security and protection that UPS shipping insurance provides. And if you’re not sure how much coverage you need, you can always use their handy online calculator to get an estimate on your package details. It’s a small investment that can make a big difference in the long run. After all, as the old saying goes, “Better safe than sorry!”

UPS Shipping Insurance Solutions

Are you tired of playing shipping roulette with your valuable packages? Say goodbye to lost, damaged, or stolen shipments with UPS shipping insurance Solutions! Whether you’re shipping rare collectibles or important business documents, our insurance options have got you covered.

So why leave the fate of your packages to chance when you can have peace of mind? Let UPS shipping insurance Solutions be your knight in shining armor and protect your packages from any unexpected mishaps.

Shopify Sellers

Are you a Shopify seller looking for a hassle-free way to add shipping insurance to your orders? Look no further than the InsureShield® App! With just a few clicks, you can set your insurance preferences and offer protection during checkout. Plus, you can track and manage claims online. The best part? The app is free to install and use; you only pay for insurance when you ship. It’s a no-brainer for peace of mind and happy customers.

Customized Insurance

Are you shipping high-value items and worried about their protection? Don’t sweat it! UPS Capital® Insurance Services is here to offer you customized insurance solutions, trade credit protection, continuous customs bonds, and cargo liability. They make insurance easy and tailored to your business needs. And who wouldn’t want that?

Plus, with their expertise, you can be sure that your items are in safe hands. So, why wait? Get in touch with them today to design a policy that suits your business and industry like a glove. Trust them; your peace of mind is worth it!

Single Shipment

Are you tired of dealing with the hassle of insuring shipments every time you send something out? Look no further than InsureShield® OnDemand! With transactional pay-as-you-go protection for all carriers and modes, you can rest easy knowing your one-time or infrequent shipments are covered. And the best part? You can get a quote and purchase insurance online in just a few minutes, with the added convenience of filing and tracking claims online. Say goodbye to the headache of traditional insurance and hello to InsureShield® OnDemand!

When to use UPS Shipping Insurance?

Looking to ship your precious belongings but worried about their safety? UPS shipping insurance has got you covered! Here are some situations where you should consider using UPS shipping insurance.

- Firstly, if your shipment is worth more than $100, purchasing additional declared value coverage is a good idea. While UPS provides up to $100 of basic coverage for most shipments, adding extra coverage will give you peace of mind, knowing that your valuable items are protected.

- Secondly, if your shipment is fragile, valuable, or irreplaceable, you definitely want to consider UPS shipping insurance. We all know that electronics, jewelry, artwork, or antiques require extra care during shipping. In case of any damage or loss, UPS shipping insurance will help you recover the full value of your item.

- Lastly, when your shipment is going to a risky destination, you need UPS shipping insurance to mitigate the risks and ensure your shipment arrives safely and on time. Some destinations may have higher theft rates, damage, or delivery delays. Still, with UPS shipping insurance, you can rest easy knowing that you have taken the necessary precautions to protect your shipment.

How do you file a UPS shipping insurance claim?

Shipping can be a risky business, but fear not, my friend – the cavalry is here to help! If your UPS delivery took a tumble, went on a detour, or got lost in space (okay, maybe not that last one), we’ve got your back.

Sit back, relax, and let’s walk through the steps of filing a UPS shipping insurance claim like a boss. If you’re looking to file a claim for a lost or damaged package, don’t worry – it’s easy peasy! Just follow these simple steps:

- Step 1: Visit the UPS website at www.ups.com and sign in to your account. Don’t have an account yet? No problem, just register – it’s quick and painless!

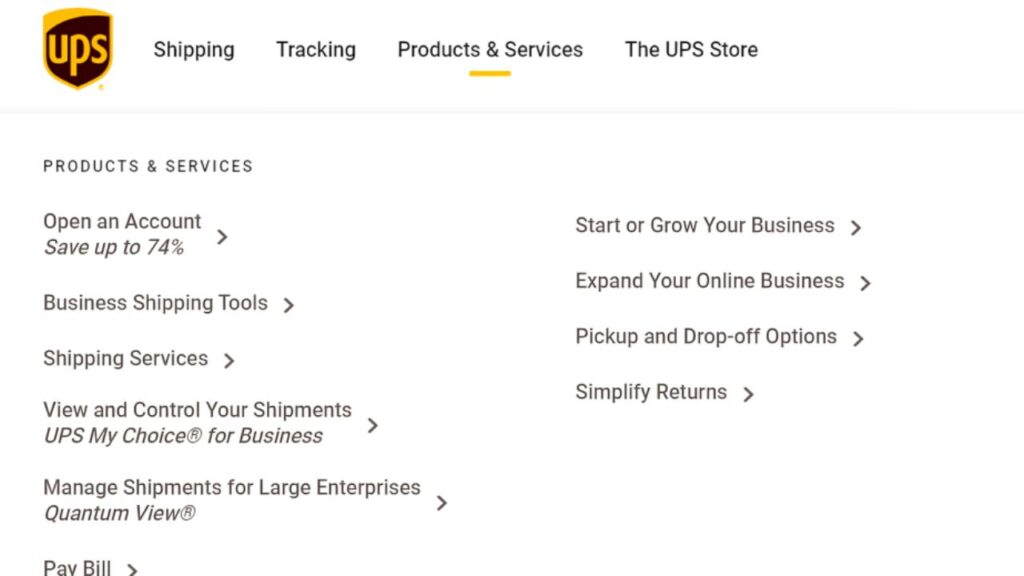

- Step 2: Click on Products & Services at the top of the homepage and select File or View a Claim from the drop-down menu. You’re on the right track!

- Step 3: Enter the tracking number of the lost or damaged package and fill out all the necessary information about the package and the issue at hand. Don’t worry; we won’t make you write an essay – just the important details.

- Step 4: Provide details about your role in the claim, such as the sender, receiver, or third party. You may also need to provide supporting documents, such as receipts, invoices, photos, or proof of value. We promise we’re not trying to make this difficult – we just need to make sure we have all the info we need to help you out!

- Step 5: Submit your claim and await UPS’s confirmation email. You can also track the status of your claim online or by phone. We’ll keep you updated every step of the way!

Conclusion

Shipping insurance is an essential step in protecting your goods during transit. This guide has highlighted the key benefits of UPS shipping insurance, which includes coverage for lost or damaged packages and the process of filing a claim.

However, with so much to consider, it can be overwhelming to manage shipping logistics on your own. That’s where NextSmartShip Fulfillment comes in. Their experts are equipped with the latest technology and logistics know-how to ensure your packages are shipped safely and efficiently.

So, whether you’re a small business owner or an individual shipper, consider partnering with NextSmartShip Fulfillment to streamline your shipping process and gain a stress-free mind knowing your goods are in good hands. Don’t let shipping stress you out – let NextSmartShip take care of it for you!